what is an open end equity lease

It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital. Ford Taurus with standard fleet equipment.

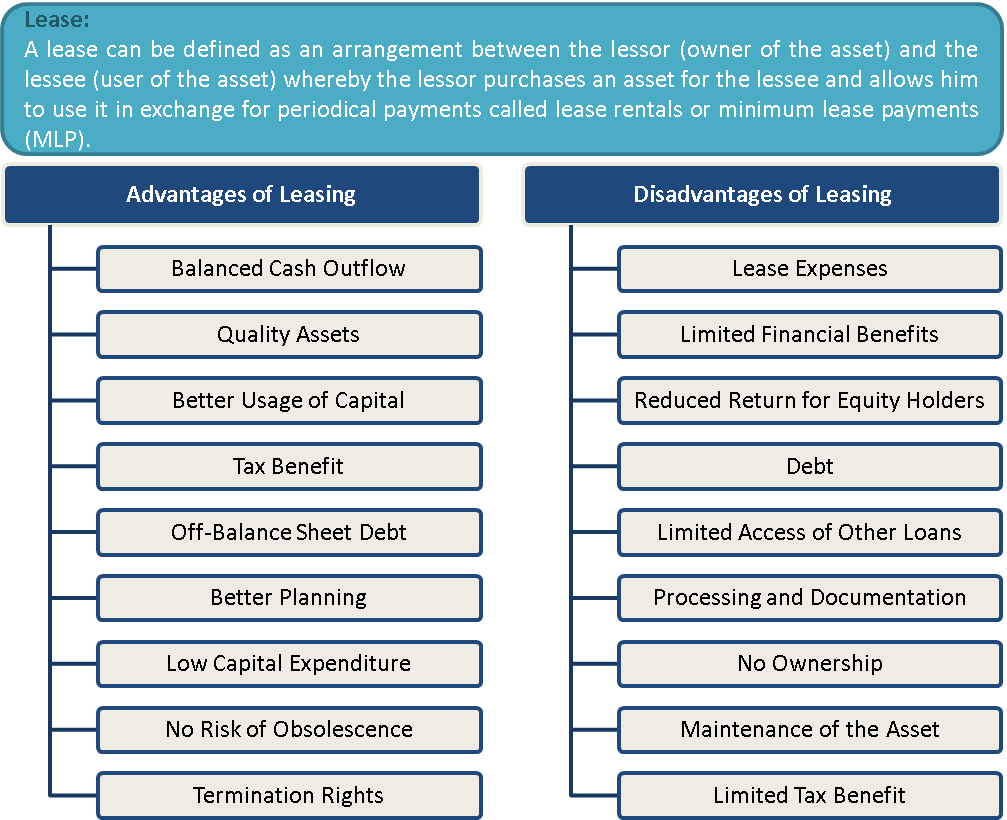

What Is Leasing Advantages And Disadvantages Efinancemanagement

The dealer will refer to this value as the residual value.

. Master open-end vehicle lease agreement local govt 2019 page 4 rights defenses and claims against lessor which relate to the vehicle arising under the ucc or similar applicable law. In most open-end leases you are also entitled to any refund if the actual. Depending on the model and contract you could be allowed anything from 30000 miles to 60000 miles in the three years that you keep the car.

This works well for employers since the cost of the vehicles can be written-off or expensed. A lease contract for a car allows you to drive the car make payments for a certain number of months and then turn the car back in to the leasing company. Transitioning from a purchase program to a lease option will result in.

When you lease a car you dont own it unless you buy it at the end of the term. Open-end leases also exist and are most often used in the case of commercial business lending. When you lease a car you dont get to drive it as much as you want.

This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. He will pay the bill if the depreciation is worse than expected. What is an open-end lease.

In that sense there is no mileage limit on the lease agreement. Understanding Lease Equity. An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing.

In fact a 2021 iSeeCars analysis shows cars leased three years ago have on average 7000 worth of equity built up. CLOSED END LEASE COST COMPARISON. Closed End Prime 10 percent.

Vehicle used 36 months60000 miles. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule. The lessee guarantees a value on the vehicle at the end of its use.

Open End One-month LIBOR 50 percent. Open-ended leases allow landlords and tenants to change the conditions of their lease agreements with a 30-day written notice unless otherwise specified. Open-End Lease The open-end lease put the lessee responsible for the residual value ie.

We just have to think of transport and courier companies they prefer to amortize the real cost of depreciation instead of paying. What lease equity means. Open- and closed-end leases.

The lease contract spells out the framework of the deal at the end of the lease including the projected value of the car. Lets take a closer look at the two most common options available to commercial fleets. Open End 36 months.

Based on 1 documents. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk. The open-end lease puts all the financial risks on the lessee.

This happens when the lessee drives less than the mileage allotted. What is an open ended equity lease. Equity lease means a lease of real property that requires a specified rental amount payable as a lump sum for the entire term of the lease but which may allow for payment of the rental over time by periodic payments subject to payment of interest on the unpaid balance owing from time to time.

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. College has been in discussions with Enterprises Fleet Management group regarding an open-end equity lease option that allows for continued replacement and coverage of most costs associated with maintaining those vehicles. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

The employer takes all the financial risk. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began. However it is possible in some cases and we can explain how this can happen.

If you go over your mileage limit you will be. In an open-end lease the lessee agrees to a minimum term thats. Lessor shall not be liable to lessee for any loss damage or expense of any kind or nature caused directly or indirectly by the.

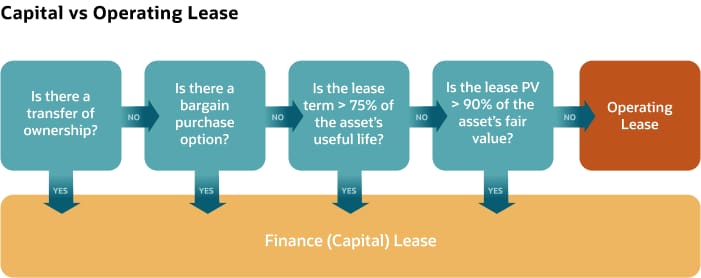

In a closed-end lease the lessor takes on the depreciation risk but the terms are more. Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare. Part of what Enterprise is able to provide is known as an open-end equity lease a structure that is designed for the county to pay as little.

An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement amounting to the difference between the residual and fair market value of the asset. Rather the lease is made out for a specific mileage level. Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal.

Closed End 36 months55000 miles07 per mile beyond 55000 miles.

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

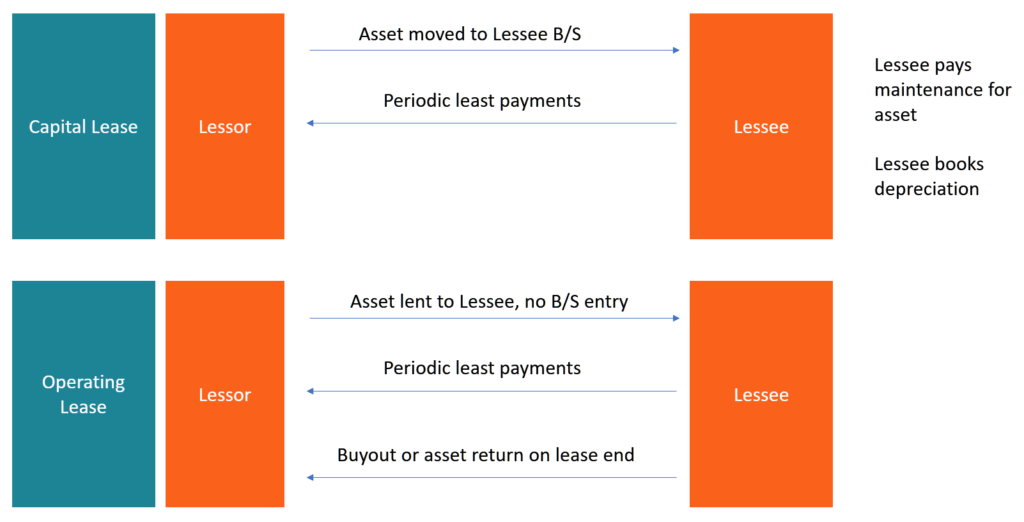

Capital Lease Vs Operating Lease What You Need To Know

Lease Accounting Calculations And Changes Netsuite

Auto Leasing 201 Synchrony Bank

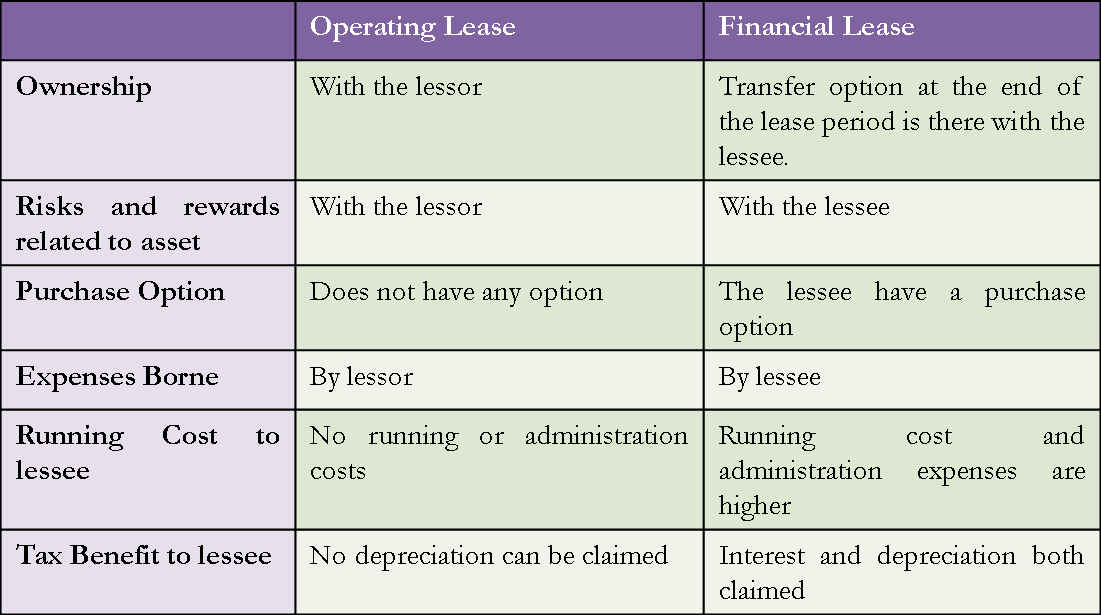

Advantages And Disadvantages Of Capital Lease Accounting And Finance Financial Management Economics Lessons

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

Difference Between Operating Versus Financial Capital Lease Efm

Hsbc Mutual Fund Launches Hsbc Mid Cap Fund In 2021 Smart Money Growing Wealth Asset Management

Lease Accounting Calculations And Changes Netsuite

The Benefits Of Owning A Home Arent Always Just Building Equity Although Its Always A Plus Freedom To Make Dec How To Better Yourself Equity Home Ownership

Vintage Domino S Avoid The Noid Pvc Premium Figure Etsy Domino Pvc Original Bags

Lease Accounting Calculations And Changes Netsuite

Cost Of Capital Cost Of Capital Opportunity Cost Financial Management

End Of Lease Letter Terminate Lease Letters Franklin In 2020 Being A Landlord Printable Letter Templates Lettering

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Open Vs Closed End Leases What To Know Credit Karma

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy