workers comp taxes texas

You retire due to your occupational sickness. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax.

Work Injury Claim Form Showing Business Insurance Concept Affiliate Claim Form Work Injury Insur Work Injury Accident At Work Personal Injury Law

The assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 010 percent of wages paid by an employer.

. You will typically not have to pay taxes on a workers compensation settlement at the state or. Call 888-434-COMP 888-434-2667 and talk to our hard-working. You do not need to claim the income benefits from workers compensation you receive on your taxes.

Texas Department of Insurance 333 Guadalupe Austin TX 78701 PO. The quick answer is that generally workers compensation benefits are not taxable. Workers Comp Exemptions in Texas Sole-Proprietors and Partners who include themselves on a workers compensation policy must use a flat payroll amount of 63100 for rating their overall workers compensation cost.

For instance welfare benefits and compensatory damages awarded for physical injury are not considered taxable income. We encourage you to speak with a financial professional to make sure that you follow all. Texas workers compensation law has caught up to these types of games that employers play.

Workers Compensation Texas Law. Most income earned by Texas residents is taxable and so must be reported on their federal tax returns. Texas unlike other states does not require an employer to have workers compensation coverage.

Texas workers compensation insurance gives your employees benefits to help them recover from a work-related injury or illness. Subscribing to workers compensation insurance puts a limit on the amount and type of compensation that an injured employee may receive - the limits are set in. Workers compensation premiums in Texas cost 79 of the national median.

Provides for reimbursement of medical expenses and a portion of lost wages due to a work-related injury disease or illness. Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums. Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements under the Texas Workers Compensation Act.

Texas calculates these benefits under a formula. In most cases they wont pay taxes on workers comp benefits. Vary each year as adopted by the Texas Department of Insurance.

70 of the difference between your average weekly wages and the wages you are able to earn after your injury or 75 of the difference if you earned less than 10 an hour. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. The benefits from workers compensation are typically not taxable in Texas.

Answer Simple Questions About Your Life And We Do The Rest. If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for them. However retirement plan benefits are taxable if either of these apply.

The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of employers for experienced-rated accounts and the average experience tax rate is 106. Similarly those who receive a workers compensation. Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future.

Do you claim workers comp on taxes the answer is no. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for them.

Obtain an instant quote and purchase a policy online or contact our partner Clarke White at 804-267-1210. Texas Workers Compensation Rates by Class Code The estimated Texas workers compensation rates by class code below are part of the Oregon workers compensation premium rate ranking study. In our system some independent contractors get workers compensation benefits.

Benefits are available only. However there are some situations when this general rule does not apply. File With Confidence Today.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. The insurance carrier has one goal. In General Workers Comp Settlements Are Not Taxable For the most part you will not have to list workers compensation settlement money as income when filing your taxes.

Workers comp taxes texas. Money from the assessment is deposited to the credit of the employment and training investment holding fund. These policies pay for medical expenses and lost wages if an employee has a work-related injury or illness.

Household employers in Texas are not required to carry a workers compensation insurance policy however we recommend doing so. Workmans comp in Texas can also help employers because it provides a defense against claims of. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Texas requires that all businesses involved in projects for government entities carry workers compensation insurance. Box 12030 Austin TX 78711 512-676-6000 800-578-4677. To limit or dispute your medical care and your entitlement to income benefits.

25 Workers Comp Insurance Hacks A Cheat Sheet For Small Businesses

Workers Compensation Attorneys In York Pa Free Confidential Consultation

A Quick Guide To Workers Compensation In Texas Employers

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Is Workers Comp Taxable Hourly Inc

Texas Non Subscriber How Can Injured Worker S Get Compensation

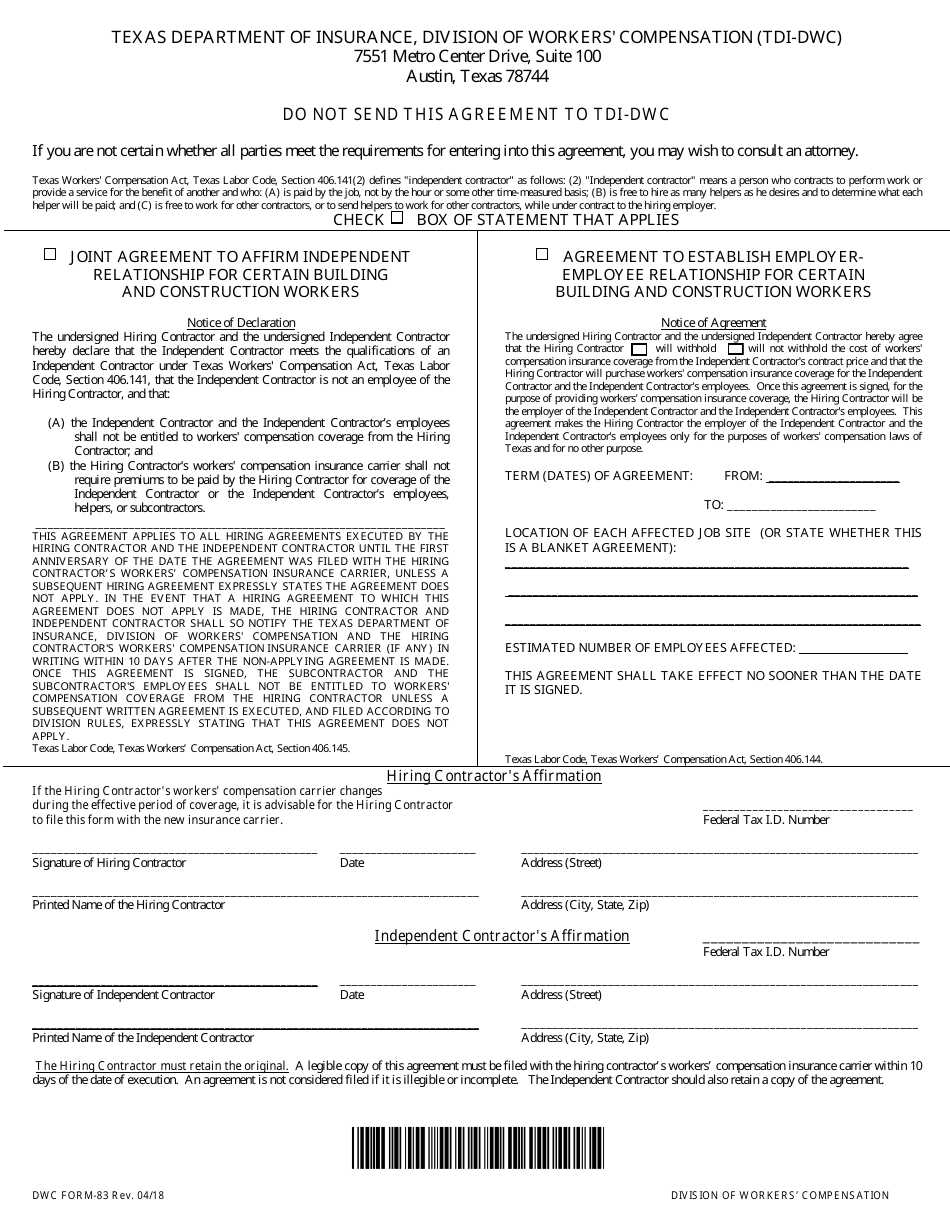

Form Dwc83 Download Fillable Pdf Or Fill Online Agreement For Certain Building And Construction Workers Texas Templateroller

Are My Workers Comp Benefits Taxable In Massachusetts

5 Best Workers Comp Insurance In Massachusetts Bravopolicy

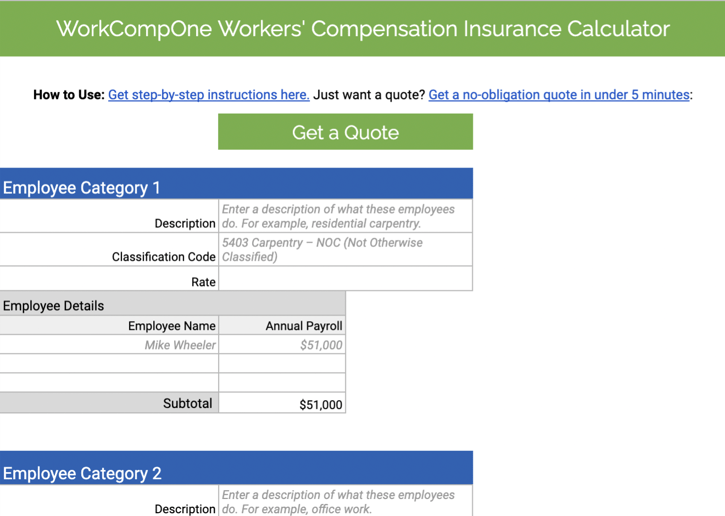

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Texas Workers Compensation Insurance Laws Forbes Advisor

5 Requirements For Workers Compensation Eligibility

What Wages Are Subject To Workers Comp Hourly Inc

Is Workers Comp Taxable Workers Comp Taxes

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Workers Compensation Insurance Workmans Comp Insurance Quotes

How To Reduce Workers Compensation Insurance Costs Employers Resource

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Workers Compensation Insurance In Lancaster Workers Compensation Insurance Work Injury Injury Lawyer